The government contracting M&A landscape has undergone transformation in recent years due to dynamic industry and macroeconomic factors. Macro drivers of these changes include among other things (i) the peaking and wind down of major OIF and OEF activities, (ii) the 2008 global financial crisis and ensuing weak US (and global) economy, and (iii) the passage of time since the tragedies of 9/11 without further successful terrorist incidents in the US. These macro factors have led to a particularly challenging budgetary environment with fewer and different spending priorities. This tightened market has resulted in lower valuations for the publicly traded government contractors and materially influenced M&A acquisition interests in laser-like fashion towards particular capability or technology offerings (thought to be in future demand) and / or accessing or expanding presence in well-funded markets / agencies. These trends along with growing private equity interest in the sector supplemented by favorable debt financing markets define today’s active M&A market.

The government contracting M&A landscape has undergone transformation in recent years due to dynamic industry and macroeconomic factors. Macro drivers of these changes include among other things (i) the peaking and wind down of major OIF and OEF activities, (ii) the 2008 global financial crisis and ensuing weak US (and global) economy, and (iii) the passage of time since the tragedies of 9/11 without further successful terrorist incidents in the US. These macro factors have led to a particularly challenging budgetary environment with fewer and different spending priorities. This tightened market has resulted in lower valuations for the publicly traded government contractors and materially influenced M&A acquisition interests in laser-like fashion towards particular capability or technology offerings (thought to be in future demand) and / or accessing or expanding presence in well-funded markets / agencies. These trends along with growing private equity interest in the sector supplemented by favorable debt financing markets define today’s active M&A market.

From 2001 through 2007, larger acquisition targets were viewed more favorably given their breadth of services and entry points to new agencies as newly public firms used their fresh IPO capital to grow and Defense Primes built out their “services” businesses. However, as Federal budgets have tightened, especially for discretionary initiatives, and SBA Regulations have introduced greater uncertainty around continuation of set-aside awards post-transaction, industry buyers have become much more selective in their acquisition strategies. In addition to only focusing on a few key areas (e.g., cyber, health), there has a been a noticeable “flight to quality” as buyers’ seek sustainable competitive advantages—including technical expertise and customer intimacy, unrestricted or “full and open” contract vehicles, strong recruiting and business development functions, and robust technologies, repeatable processes, or scalable infrastructure—as the larger players prepare (or upgrade themselves) for an even more competitive future. The M&A landscape has also become somewhat more defensive for buyers—with less emphasis placed on acquisition size, and significantly more focus on mitigating acquisition risks by (i) ensuring no conflicts exist from an OCI standpoint; (ii) identifying targets with sustainable organic growth and strong profitability; and (iii) the potential to leverage distinguishable competitive advantages in proprietary tools / technologies.

Increased Emphasis on Priority Areas

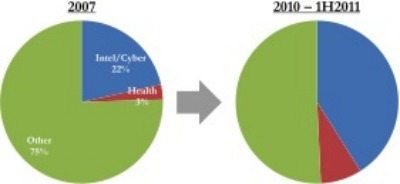

| Government Services Transactions by Market Focus

|

It can safely be said that the “80/20 rule” applies to industry deal activity these days. The vast majority of buyers are increasingly oriented towards Cybersecurity, cost efficiencies (e.g., data center consolidation, cloud computing), Intelligence, C4ISR, and Healthcare (~20% of the targets). These areas are perceived to be the high priority, stable or growing markets of the future and all the larger firms want to increase their capabilities (and the proportion of their companies) in such areas. Secondary areas of interest include training, State Department, logistics, and Gov / Web 2.0.

Thinking Small(er)

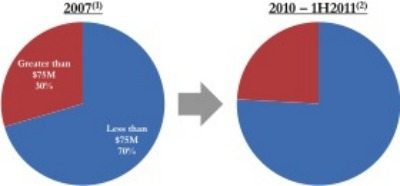

| Government Services Transactions by Size

(1) Based on 88 transaction where metrics were disclosed or estimated by KippsDeSanto (2) Based on 116 transaction where metrics were disclosed or estimated by KippsDeSanto |

Along those lines, while large, high profile deals such as the SRA or GTEC going-private transactions typically dominate the headlines, the recent M&A trend has been towards smaller, more focused transactions. Buyers are increasingly interested in smaller targets that have considerable depth in coveted agencies or unique security, Intel or healthcare technologies or capabilities without the added “baggage” of slow or declining business in non-priority areas (often found in larger targets).

Increased Private Equity Activity

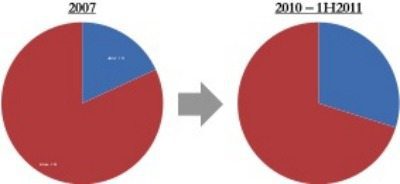

| Government Services Transactions by Buyer Type

|

Either as a new platform or an add-on to an existing investment, private equity has become increasingly active in the government services space especially among the targets not fully positioned in the priority areas (where the large strategic buyers are generally focused). Long-term contracts and high cash flow of government contracting lends itself to leveraged acquisitions. With more favorable debt financing available, and valuations for the many firms lower, private equity firms are seizing the opportunity to achieve targeted returns while committing less equity and more debt for a given transaction.

————————————————————————————————————————————————-

ABOUT THE AUTHOR

Robert D. Kipps is a founder and Managing Director at KippsDeSanto, a leading investment banking firm. Learn more about Mr. Kipps here.