DLH Holdings Corp. has acquired privately-held public health research company Social & Scientific Systems in a $70 million deal that will allow SSS to operate as a wholly-owned subsidiary.

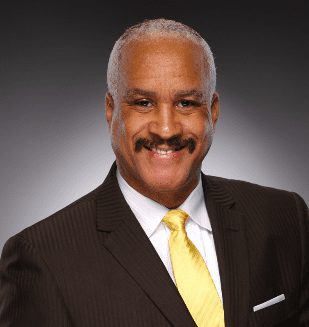

“This is an exciting addition to DLH and one that aligns perfectly with our strategy to expand the company’s public health and life sciences focus area, diversifying our portfolio and bringing scale to support growth,” said Zachary Parker, president and CEO of DLH. “In addition, we’ll augment our executive team with the high caliber leadership demonstrated by (SSS president) Kevin Beverly. With over 40 years in business, SSS is a nationally-recognized technology-enabled health research organization that collects, manages and analyzes large-scale health data in support of critical public initiatives – complementing and broadening the markets we serve within the federal government.”

DLH employs more than 1,600 individuals and provides technology-enabled solutions related to health and human services programs to federal clients. SSS employs about 400 and provides solutions in clinical and biomedical research, epidemiology, and public health research, health policy and program evaluation.

DLH anticipates SSS, which is based in Silver Springs, Maryland, will contribute about $65 million in revenue annually. The SSS backlog was approximately $346 million at closing, which company leaders said reflects the long term nature of its research and studies contracts. The funded component of the backlog was approximately $40 million.

Beverly said he looks forward to working with Parker and his team.

“I’m very pleased that SSS has found, in DLH, a great partner with which to continue delivering high-quality health policy, data analytics and public health services to federal agencies,” Beverly said. “Not only does DLH share a similar vision and corporate culture, but the company is dedicated to improving the lives of citizens across the U.S. and around the world. DLH has a reputation for providing a disciplined approach to achieving excellent customer service – including CMMI and ISO certifications – and valuing its employees.”

DLH financed the acquisition through a new 5-year, $95 million, secured bank credit facility. First National Bank of Pennsylvania acted as agent, and F.N.B. Capital Markets and M&T Bank were joint lead arrangers. The facility is composed of a syndicated term loan of $70 million and revolving credit facility of $25 million.