Bob Kipps from KippsDeSanto & Co. expects the robust GovCon M&A market from the last couple years to continue into 2021. Here, he gives a review of the year that just passed and his outlook for 2021.

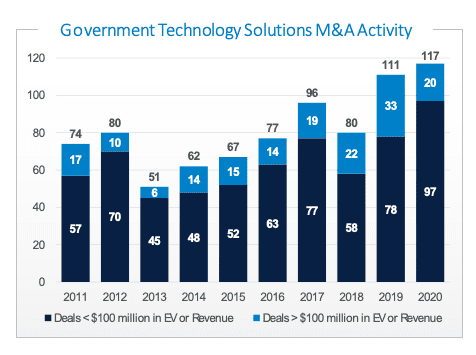

As shown in our table below, 2020 (remarkably) has seen more closed deals than 2019 and any year in the last 20 years notwithstanding the COVID pandemic. Valuations for both the sector’s public firms as well as on M&A transactions remain at or near record levels as well.

KippsDeSanto anticipates closing ~20 industry transactions in 2020, including Braxton Technologies’ $300 million deal with Parsons, Tapestry Technologies’ sale to ManTech, TeraThink’s sale to CGI and POC’s $310 million announced deal with Mercury Systems, among others.

Absent another black swan event, we see robust M&A conditions to continue into 2021. Capital markets have surged in late 2020 based on promising news on the COVID-19 vaccine front, recent election results and the overall low interest environment. While control of the Senate is predicated on January’s Georgia runoff election, the market is viewing enduring national security threats and ongoing IT modernization efforts as a stabilizing factor on Defense Department and another contractor addressable budgets notwithstanding the spending on pandemic support and overall increasing national debt situation.

Business owners (both institutional and entrepreneurs) are being drawn into the market for normal reasons (e.g., age and/or hold periods), attractive valuations and fear of potential tax increases (corporate and capital gains). The buyer market for the best industry targets continues to be deep and broad. Strategic buyers like Leidos (1901 Group), ManTech (Tapestry) and Parsons (Braxton) all have strong balance sheets, strong market valuations and strategies that meaningfully involve M&A as they position themselves to have the requisite technologies and offerings and critical mass in the agencies and areas — such as space, cyber and IT modernization — that are expecting to see growth and/or budget stability for the longer term.

Private equity continues to flow into the sector both from seasoned industry firms — like Veritas (Peraton/NGIT and DXC), Arlington Capital (J&J, BlueHalo and Octo/Sevatec) and AE Industrial (Gryphon and NuWave) — as well as newer entrants — like Welsh Carson (GovernmentCIO) and OpenGate (Aurotech).

Private equity has established 50 new government services platforms over the past 3 years, while only exiting out of 27 — meaning there are 20+ more private equity platforms looking for acquisitions than in 2017. Private equity firms are now involved as buyers in roughly 50% of industry transactions.

We all wish to forget about the health concerns and economic issues caused by COVID this year. Looking ahead, 2021 should be another super active year on the M&A front.